Fraud Prevention

Stay Vigilant: Protect Yourself and Loved Ones from Scams

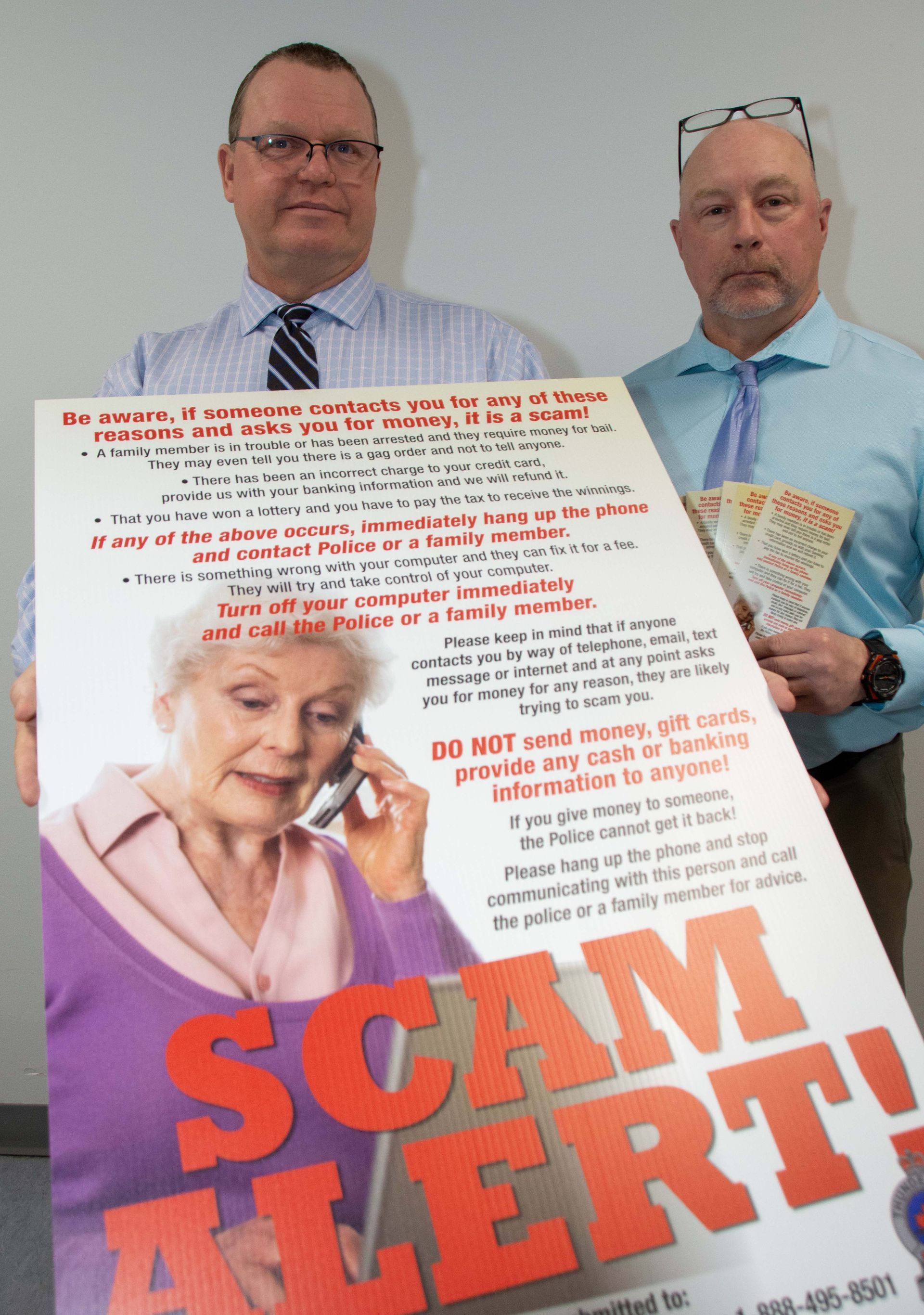

The Thunder Bay Police Service’s Economic Crime Unit urges family members and friends to speak to those who may be vulnerable to being targeted by scams.

Police advise community members contacted by a suspected scammer to remember that the best way to avoid being victimized is to hang up the phone or delete the messages.

Fraudsters may attempt to manipulate their victims by claiming there is a sense of urgency to act. This is a common tactic to prevent victims from practicing due diligence and should be viewed as strong evidence that a scam is taking place.

In situations where there is an incentive or reward being offered, if something seems too good to be true then it probably is. Do not provide personal information, such as a credit card number. Do not agree to meet with people who are not known to you.

For further information about various frauds and scams that may be circulating, please visit the Canadian Anti Fraud Centre online at: https://antifraudcentre-centreantifraude.ca/index-eng.htm

To make an online report of Fraud/Cybercrime, please visit this link: https://www.services.tryrubicon.com/thunder-bay-police-service/online-reports/report/fraud-cybercrime

TYPES OF SCAMS

Grandparents Scam

Scammers will call potential victims, claiming that a family member was involved in an accident or had been arrested, with money urgently needed to address their situation. The fraudster may claim to be a lawyer or law enforcement officer.

These calls frequently target elderly residents or other vulnerable individuals.

Police advise community members contacted by a suspected scammer to remember that the best way to avoid being victimized is to hang up the phone, then attempt to reach the family member alleged to be in trouble to verify the story.

The fraudster may attempt to dissuade a victim from doing this by claiming the money is required immediately. This is a common tactic to prevent victims from practicing due diligence and should be viewed as strong evidence that a scam is taking place.

Compromised Bank Card Scam

Residents will receive a phone call from a scammer claiming to be bank fraud investigators. The scammers then attempt to have the resident provide them with personal information, including account details and PIN numbers.

The resident is told that their card has been compromised and that a "courier" will come to collect their cards.

A scammer then attends the residence, collects their bank card, and uses it to make fraudulent purchases or cash withdrawals.

Legitimate fraud investigators will never ask an individual who may be the victim of fraud to provide their PIN number over the phone. They will also never attend a personal residence to take possession of bank or credit cards. If in doubt, hang up the phone and contact the number listed on the back of your card.

Rental Property Scam

People have been scammed out of deposits after responding to online postings for housing rentals. The victims had been in contact with people claiming to be the landlords and e-transferred funds to the provided email addresses. Communication with the supposed landlords stopped after funds were transferred.

Fraudsters will often try to get the victim to pay a deposit or move-in fee without allowing the victim to view the rental unit beforehand, and will likely have several excuses for why they are unable to meet in person. They may also claim the listing is in high demand and there is a sense of urgency to act, with a deposit required immediately to secure the unit.

High-Interest Mortgage Scheme

The scam features individuals portraying themselves as door-to-door salespeople initially offering to install equipment in the home or conduct renovations, with the homeowners asked to sign long-term contracts.

That may result in liens being filed on the home. The homeowners are then approached with an offer to consolidate the debt, using the home as collateral, and are then pressured or tricked into signing high-interest mortgages with rates up to 25 per cent.

The high rate of the mortgages can jeopardize the victims’ ownership of their homes, especially for people with low or fixed incomes.

Compromised Business Email

Scammers compromise the email account associated with a business, and then contact clients purporting to be the business representative. The scammer advises the clients of changes to banking information and provides a different account.

Funds are then sent to a scammer's account, rather than the business.

If there is concern or uncertainty about whether a message is a scam, please directly contact the business or institution. Look up the contact numbers independently and never use information provided by a possible scammer.

Shoulder Surfers

People should be aware of their surroundings when using a debit or credit card to make purchases.

Scammers will closely watch customers when making purchases to obtain their personal identification number (PIN) before stealing the card, and then using it for their own transactions.

These scammers, known as shoulder surfers, often take advantage of seniors.

Threatening Text Messages

Scammers will send aggressive extortive text messages, which are claimed to have been sent by the boss of an escort service, threatening possible harm to the recipient and members of their family unless they provide payment.

Anyone receiving these kinds of messages should disregard them and not respond. Do not provide any form of payment.

Fraudulent Financial Services Letter

A letter is sent, purportedly from a financial services company, advising that the recipient was owed funds that had yet to be paid.

The letter provided a phone number to contact for the payment to be issued. The provided phone number is not visible anywhere on the company's website.

In addition, the letter and envelope do not appear to be legitimate, with the content of the letter not seeming to be of an expected professional standard and the letterhead not appearing to be genuine.